Governance Resource Guide for Board Members of Employee-Owned Companies

Introduction: Purpose of this Guide

This guide is intended as a resource for board members of employee-owned companies. Ventura Trust has developed this resource based on our experience as trustee, consultants, and board members, as well as staying abreast of ESOP best practices.

These materials are provided for information purposes only and should not be construed as legal advice. ESOP-owned companies should consult legal counsel on board systems and processes to ensure compliance with applicable laws and regulations. In particular, the examples included in the Appendix are for informational purposes only and should be reviewed by your ESOP attorney to see if they’re appropriate for your company.

For additional resources, we encourage you to review:

NCEO’s The ESOP Company Board Handbook

NCEO’s Board Excellence Toolkit and Candidate Directory

Governance webinars from NCEO

Education and resources from the Private Directors Association

Part 1: Overview on Role of the Board

What is governance?

Corporate governance is a framework to govern the relationships among a corporation’s shareholders, directors, and officers. It refers to the systems and processes by which directors oversee officers and the business. A corporate governance system includes the board of directors, corporate officers, and its shareholders.

In every corporation, the shareholder(s) elect the board of directors, who have a fiduciary obligation to act in the best interest of the company’s shareholders. In turn, the board of directors appoints and monitors corporate officers, including the CEO or president of the company.

Corporate Duties

Standards for corporate governance arise from corporate fiduciary duties. These standards are based primarily on state corporate law and related case law, though may also be affected by federal statute and case law. While there may be differences among states, state law generally establishes the following as fiduciary duties of board directors and officers:

Duty of Care, which requires directors and officers to be informed and perform their duties in good faith with the care that an ordinarily prudent person in a like position would exercise under similar decisions. This means being fully informed, deliberating carefully, and exercising independent judgement.

Duty of Loyalty, which requires directors and officers to exercise their powers in good faith and in the best interests of the corporation, not their own interests or the interests of another entity or person. Essentially, directors and officers must avoid conflicts of interest, as well as the appearance of conflicts of interest.

Corporate boards are protected by the business judgment rule. This rule acknowledges that every business decision involves some type of risk. The board of directors should be allowed to make business decisions without fear of prosecution by shareholders, so long as the board has acted with care and loyalty in their decision-making.

Governance in an ESOP setting

There are several things that are unique about being on an ESOP board. Most importantly, the ESOP Trustee is a special type of shareholder. As a qualified retirement plan, there are additional standards for ESOP governance that arise from Employee Retirement Income Security Act (ERISA) fiduciary duties. These standards are based primarily upon ERISA and related case law. They’re also affected by state corporate law.

ERISA is a US. Federal tax and labor law that establishes standards for retirement plans in private companies. When it was enacted in 1974, ERISA codified ESOPs by making them part of retirement plan law. Under ERISA, an ESOP is a tax qualified defined contribution retirement plan and is therefore subject to most of the same requirements for eligibility, vesting, and allocation as other retirement plans.

All assets of the ESOP (e.g. company stock certificate, bank and investment accounts) must be owned by the trustee who is appointed by the Board of Directors (the Board). The Board also has a duty to monitor the actions of the ESOP trustee and can terminate the trustee. Trustees can be independent (an individual or institution or internal (an employee or committee of employees.) Ventura Trust is an independent institutional trustee.

The trustee is the shareholder of record for the corporation, not the ESOP participants who are beneficial owners. For any corporate item that requires shareholder action, such as electing the board of directors, the trustee is responsible, unless the action requires pass-through voting to participants. Which decisions trigger a pass-through the vote to participants is determined by ERISA, the ESOP plan document and state law, and is generally when one of seven defined events occur: merger, liquidation, recapitalization, sale of substantially all of the assets of the corporation, dissolution, reclassification, and consolidation.

Key Governing Documents

There are several key governing documents for any Corporation:

Articles of Incorporation – These are the formal documents filed with the state government to document the creation of the corporation. The document outlines the corporation’s name and address, purpose, as well as the amount and type of stock issued.

Bylaws – The bylaws are a set of rules established by the corporation to regulate itself. They outline the rules for conducting the corporation’s business and affairs, including the composition and election of the board, meetings of the board and shareholders, appointment of officers, powers and structure of board committees, and indemnification provisions.

Additionally, there are several key documents for the ESOP:

ESOP Trust Agreement, which establishes the Employee Stock Ownership Trust as a tax exempt trust.

ESOP Plan Document, which establishes the Employee Stock Ownership Plan and outlines the plan’s rules under Department of Labor and IRS guidelines.

ESOP Trustee engagement agreement, defines the trustee fees, duties etc.

Part 2: Putting together your Board

Board composition

As mentioned above, the bylaws will dictate the rules and processes for putting together your board as well as:

Number of board seats

Terms and term limits for board members, if any

Process for adding and removing board members

The board composition is typically negotiated in the transaction whereby the ESOP acquired a majority interest in the company. The Letter of Intent will specify the total number of board members, the number of independent directors and a timeline for those independent seats to be filled.

There is a particular focus on independent directors in ESOP-owned companies because the Department of Labor (DOL), which regulates ESOPs, has focused on whether the ESOP has actual control of the company when it’s a majority shareholder. A majority of independent directors is one way to support a conclusion of ESOP control. Having independent directors is also a best practice in reducing conflicts of interest, adding outside expertise and perspective. The exact criteria for what constitutes an independent director gets codified in the transaction documents and typically is defined as someone who is not currently employed by the company, has not recently been employed by the company, is not related to the selling shareholders and has not been paid by the company or the selling shareholder(s) in the past 12 months.

It is also important to understand the powers of the Trustee with respect to Board elections. A trustee may be directed or discretionary for the appointment of directors. A discretionary trustee can accept or reject nominations of directors, whereas a directed trustee follows the direction of the board. Similar to the majority vs. minority independent director concept above, a trustee with discretion on board elections wields more power and can support ESOP control more than a directed trustee, all else equal. Even a directed trustee must refuse direction on any matter that is contrary to the Plan/Trust documents or ERISA. Your board should understand who has the final say (and risk of the fiduciary decision) in these matters.

Identifying the Skills and Experience Needed for Your Board

When it comes to selecting qualified candidates for your board of directors, keep in mind that the needs of your board will vary over time. For many newer ESOPs, the board that is put in place may be the first formal board the corporation has had. The company may benefit from having board members with significant Board or ESOP experience. A more established ESOP-owned company that is looking to grow through acquisitions might look for independent board members with specific skills that other board members don’t have.

See Appendix A for a sample template that can be used to define and prioritize the skills that your board needs at this moment in time.

Recruitment Process

When ready to recruit independent director candidates, be prepared to share a board job description that includes:

Company overview

Company goals and challenges

Experience and skills needed

Board responsibilities and expectations

Selection process and timeline

See Appendix B for a Sample Job Description.

While there are search firms that specialize in recruiting board directors, most companies use their existing networks to recruit board members. The ESOP community is very collaborative, and many companies fill their boards by asking their ESOP advisors or members of their local or national ESOP trade organizations for introductions to potential candidates. * The NCEO has a list of individuals who want to serve as independent directors on ESOP companies.

For a company that is just forming its board, the recruitment process might be driven by the CEO or President of the company. Once a board is established, it’s typical to have a nominating committee that conducts the recruitment process.

Selection Process

Appendix C is a sample template that can then be used to evaluate potential board candidates against the priorities you’ve identified.

Board nominations must be presented to the trustee for approval as well as any other shareholders if the ESOP is not 100% owner since the shareholders elect the board of directors.

The trustee will want to understand the process you undertook to nominate board candidates. When reaching out to the trustee, provide:

Overview of how candidates were identified

Candidate’s resume

Overview of how the candidate was vetted

Explanation of why the candidate was selected

For new board candidates, the trustee may want to meet with them for an introductory interview. Once ready to elect the board, the election can take place at the annual shareholder meeting, or via written notice. See Appendix D for a sample letter of nomination.

Compensation of Officers

The board of directors has the power to establish compensation for independent directors for their responsibilities as directors and committee members. Internal directors normally are not compensated for serving as directors.

For a company that is just forming its board, the recommendation for director compensation will likely come from the CEO or president of the company. Once a board is established, it’s typical to have the compensation committee make a recommendation on director compensation.

For independent directors, most boards tend to provide a base amount per year, as well as a per-meeting fee. There may also be additional fees for serving as the board chair, a committee chair, and/or committee member. Typically, internal board members are not compensated for serving on the board.

The National Center for Employee Ownership conducts an annual compensation survey that provides comprehensive data on both executive compensation and director compensation in ESOP settings, along with board makeup and demographic questions. Other sources for compensation, not specific to ESOPs, are the National Association of Corporate Directors and BDO.

Director Onboarding

Every board member should receive the following documents when joining the board:

Articles of Incorporation

Bylaws

ESOP Documents (Trust Agreement, Plan Document, Summary Plan Description)

ESOP purchase transaction documents, if the ESOP recently acquired stock

Board member job description

Committee charters

Company’s strategic plan

Most recent ESOP valuation report

Employee handbook

Directors and Officers Liability Insurance Policy

Depending on their experience, you may also encourage them to read an ESOP-specific board resource, such as the NCEO’s ESOP Company Board Handbook.

Additionally, Ventura Trust is always happy to provide a governance training for your board as an introduction for new board members or a refresher for tenured board members.

Finally, board members should be encouraged to attend conferences or webinars hosted by the National Center for Employee Ownership and/or The ESOP Association, which often have specific tracks dedicated to board topics.

Part 3: Board Meetings and Committees

The bylaws govern the process for calling a board meeting. Many boards meet quarterly for several hours at a time and meetings are both in person and via video conference (e.g Teams, Zoom etc.).

Meeting Agenda

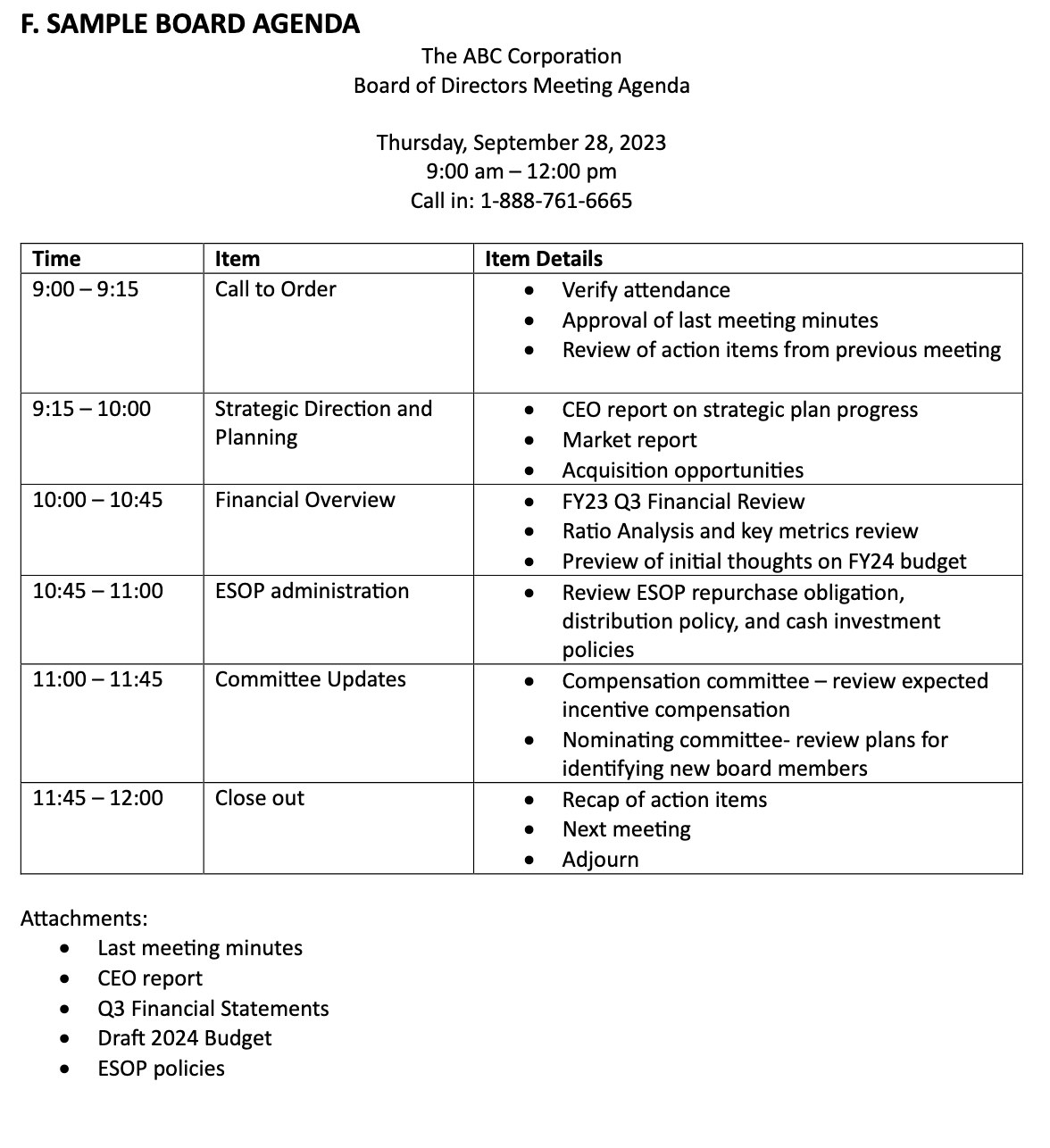

The board chair is typically responsible for establishing meeting agendas, with input from corporate officers and/or other board members. While the agenda for each board meeting will be determined based on the pressing business needs of the company, some agenda items will occur at every board meeting, such as approving the prior meeting minutes and reviewing financial reports. Other topics will occur on an annual basis or as needed. See Appendix E for a sample annual calendar that includes regularly occurring board topics.

The meeting agenda is shared in advance of the meeting. See Appendix F for a sample meeting agenda.

The board chair also ensures that the board receives all the information they need to make informed decisions and that there’s documentation of providing board members with relevant information in writing. This could come in the form of a board packet or series of reports and documents sent with the agenda.

Meeting Roles

The board chair calls meetings to order and typically facilitates the meeting.

The board secretary records attendance and documents board discussion and decisions. Following the meeting, the board secretary prepares meeting minutes that are distributed to the full board, and then approved at the next board meeting.

Board members are expected to come to board meetings having read the materials shared in advance and be prepared to ask questions.

Board Committees

The bylaws also govern the process for establishing board committees, and certain committees might have been required by the Trustee as part of the transaction negotiation.

Common standing committees for ESOP-owned companies include:

Compensation

Nominating

Governance

Other committees might make sense for your company, and your standing committees will fluctuate based on the company needs. For example, in a newly formed ESOP where the founding CEO is staying on for just a couple years after the transaction, the board may need a succession planning committee to plan for their eventual replacement.

Every committee should have a committee charter that outlines its purpose, responsibilities, composition, and structure. See Appendix G and H for sample committee charters.

Part 4: Deep Dive Into Key Responsibilities

In any corporation, the board is supposed to play a high-level strategic role, with the ultimate goal of growing shareholder value. Key responsibilities include:

Provide guidance and direction to management on company strategy and direction

Approve the annual budget

Approve the strategic plan

Monitor company performance and hold management accountable

Approve certain corporate actions, such as taking on a large amount of debt or acquiring a new company

Appoint company officers

Hire and evaluate CEO, as well as determine their compensation

Plan for key management succession

On top of the above governance responsibilities, boards of ESOP-owned companies also have a set of ESOP-specific responsibilities, which we described in more detail below.

Adopt, amend, or terminate the ESOP

Appoint and monitor the trustee: See Appendix I for a sample trustee evaluation form.

Appoint and monitor the plan administrative committee: This committee, sometimes called an ESOP committee or administrative committee, is appointed by the board to oversee day-to-day operations of the ESOP and have administrative oversight. Their responsibilities include making decisions on ESOP plan designs and amendments and making sure participants receive their allocations, statements, and distributions in line with plan rules. The committee is typically comprised of employees with ESOP knowledge, such as the CFO or CHRO. In the absence of an appointed committee, the board is responsible for ESOP administration.

Determine contributions to the ESOP, as well as any C-Corp dividends or S-Corp distributions: The board determines the percentage of total annual compensation that will be contributed to the ESOP each year, factoring in the company’s financial performance and ESOP obligations. The Board also determines if the corporation is declaring any dividends (for a C-corp) or making any profit distributions (for an S-corp), which would also go to the ESOP as a shareholder.

Adopt, amend, and monitor the company’s distribution policy for terminated ESOP participants: Many plan documents are written to comply with distribution requirements while providing flexibility to the plan sponsor. Many companies then create a separate document called a distribution policy that expands on how distributions will be made from the ESOP. This document can be revised and updated more regularly than a plan document, and may include details about the timing of distributions, lump sum threshold, number of installments if less than five years, any distribution delays for loan repayments, and segregation provisions.

Adopt, amend, and monitor the company’s cash investment policy, including for any cash held in the ESOP: Most ESOP Trustees, including Ventura Trust, are directed when it comes to handling cash in the ESOP. The board might delegate decisions about how to invest ESOP cash to an Investment Committee or outside Investment Manager, but they are responsibility for ensuring there is a clear policy for how the company will invest its cash and that the policy is followed.

Plan for the long-term financial sustainability of the ESOP, including monitoring and planning for the repurchase obligation: Unique to an ESOP is the obligation to repurchase shares from plan participants after termination of employment, as well as diversification rights that require liquidity from the company. Companies prepare for this “repurchase liability” in different ways. For example, some make additional contributions or pay S-corp distributions to the ESOP to accumulate funds within the ESOP. Other companies set aside cash in a sinking fund. One way the board can plan for the long-term financial sustainability is to require management to provide an ESOP repurchase liability funding policy, which is regularly reviewed and updated. Additionally, the board and trustee can require management to hire outside consultants to help with a sustainability study so the company can effectively plan for the ESOP’s long-term cash needs.

Respond to unsolicited offers: CEOs of many ESOP-owned companies receive unsolicited offers to buy their company via phone, email, and letters. While it can feel easy to dismiss these messages, especially if the company is looking to remain independent, this is may not be the appropriate response. ESOP fiduciary duties require any bona-fide offer to be carefully evaluated by the CEO or board according to the terms of the board’s policy for responding to unsolicited offers. The policy should include a statement that a “sale of the company is not deemed to be in the best interests of the shareholders at this time,” if in fact that is true. The policy should also outline what constitutes a bona-fide offer, how to respond to offers that get deemed to be a bona-fide offer, and when to present them to the Board. See Appendix J for a sample unsolicited offer policy.